NCERT Solutions For Class 11 Business Studies Forms of Business Organisation

NCERT Solutions For Class 11 Business Studies Forms of Business Organisation

Free PDF download of NCERT Solutions for Class 11 Business Studies Chapter 2 Forms of Business Organisation solved by Expert Teachers as per NCERT (CBSE) Book guidelines. All Chapter wise Questions with Solutions to help you to revise complete Syllabus and Score More marks in your examinations.

NCERT Solutions For Class 11 Business Studies Forms of Business Organisation

NCERT SolutionsClass 11 Business StudiesBusiness Studies Sample Papers

TEXTBOOK QUESTIONS SOLVED

I. Multiple Choice Questions

Tick the appropriate answer.

Question 1. The structure in which there is separation of ownership and management is called

(i) Sole proprietorship (ii) Partnership

(iii) Company (iv) All business organizations

Question 2. The Karta in Joint Hindu family business has:

(i) Limited liability (ii) Unlimited liability

(iii) No liability for debts (iv) Joint liability

Question 3. In a cooperative society the principle followed is:

(i) One share one vote (ii) One man one vote

(iii) No vote (iv) Multiple votes

Question 4. The board of directors of a joint stock company is elected by:

(i) General public (ii) Government bodies

(iii) Shareholders (iv) Employees

Question 5. The maximum number of partners allowed in the banking business are:

(i) Twenty (ii) Ten

(iii) No limit (i v) Two

Question 6. Profits do not have to be shared. This statement refers to:

(i) Partnership (ii) Joint Hindu family business

(iii) Sole proprietorship (iv) Company

Question 7. The capital of a company is divided into number of parts each one of which are called:

(i) Dividend (ii) Profit

(iii) Interest (ii) Share

Question 8. The Head of the Joint Hindu family Business is called (i) Proprietor (ii) Director

(iii) Karta (iv) Manager

Question 9. Provision of residential accommodation to the members at reasonable rates is the objective of

(i) Producer’s cooperative (ii) Consumer’s objective

(iii) Housing cooperative (iv) Credit cooperative

Question 10. A partner whose association with the firm is unknown to the general public is called

(i) Active partner (ii) Sleeping partner

(iii) Nominal partner (iv) Secret partner

Answer:

1. (iii) 2. (ii) 3. (ii) 4. (iii) 5. (ii)

6. (iii) 7. (iv) 8. (iii) 9. (iii) 10. (iv)

II. Short Answer Type Questions

Question 1. For which of the following types of business do you think a sole proprietorship firm of organization would be more suitable, and why?

(i) Grocery store (ii) Medical store

(iii) Legal consultancy (iv) Craft centre

(v) Internet cafe (vi) Chartered accountancy firm

Answer: Sole proprietorship will be more suitable for grocery store, medical store, and internet cafe because:

- It has easy formation and closure.

- It needs limited resources.

- He will be sole risk bearer which is not so high and profit recipient.

- He will have 100% control.

Question 2. For which of the following types of business do you think a partnership firm of organization would be more suitable, and why?

(i) Grocery store (ii) Medical store

(iii) Legal consultancy (iv) Craft centre

(v) Internet cafe (vi) Chartered accountancy firm

Answer: For legal consultancy and chartered accountancy firm, partnership firm will be more suitable because it has:

- Ease of formation and closure

- Balanced decision making

- More funds

- Sharing of risks

- Maintain secrecy

Question 3. Explain the following terms in brief:

(i) Perpetual succession (ii) Common seal

(iii) Karta (iv) Artificial person

Answer: (i) Perpetual Succession: Perpetual succession refers to continuous succession of a corporation. Perpetual succession is one of the remarkable features of a corporation. The very objective of a corporation is to have a perpetual succession, for there can not be a succession forever without incorporation. The company has perpetual succession. The death or insolvency of a shareholder does not affect its existence. A company comes into end only when it is liquidated according to provision of the Companies Act.

(ii) Common Seal: The expression ‘Common Seal’ is not defined in the Companies Act, 1956. General practice is to adopt the Common Seal, at the first Board Meeting of the company. It must be kept under the safe custody of authorized director/officer. The Articles of Association, may set out how and when the common seal has to be affixed.

(iii) Karta: Karta is the head of Joint Hindu family business. He has unlimited liability and final decision making power.

(iv) Artificial Person: A person in the eyes of law is called an artificial person. An entity which has a separate legal entity in the eyes of law is called artificial person. A joint stock company and a cooperative society are artificial persons.

Question 4. Compare the status of a minor in a Joint Hindu Family Business with that in a partnership firm.

Answer: A minor becomes a member of Joint Hindu Family Business by virtue of his birth. On the other hand, in partnership, minor can be a partner only in profits.

Question 5. If registration is optional, why do partnership firms willingly go through this legal formality and get themselves registered? Explain.

Answer: However registration is optional, partnership firms willingly go through this legal formality and get themselves registered because it has some merits:

- Settlement of Claims: Registered firms can file suit against the third parties. So the rights of registered firms are safeguarded by law. But an un-registered firm or its partner cannot enforce its claim against the third parties or its co-partner.

- Protection of Rights: The rights and privileges of new partner are also protected in registered firm. But if incoming partner fails to register himself, he will incur great risk, because he will not be in a position to file suit for his dues against his firm or his co-partners.

- Protection of Property: The property of the retired or deceased partner continues to be liable for the acts firm does after his death or retirement until public notice is served for the change to registrar, So there is strong inducement for partners of registered firms to have the changes noted in the register. But if there is unregistered firm, the private property of the out-going partner will be considered liable to charge the debts in spite of retirement.

- Protection to Creditors: Registered firm has to maintain correct, complete and up-to-date record of its partners who will be liable for the obligations of the firm. The statement recorded in the register regarding constitution of firm would afford a strong safeguard against untrue refusal of partnership and the evasion of liability to persons who want to deal with the firm.

Question 6. State the important privileges available to a private company.

Answer: A company can be registered as a private company or a public company. When a company is incorporated as a private company, it enjoys certain privileges and exemptions when compared to a public company.

Some of the privileges enjoyed by a Private Company are:

- The minimum number of members required to form a Private Company is only 2, whereas it is 7 in case of a Public Company.

- A Private company can start its business immediately after its incorporation. It need not obtain the Certificate of Commencement of Business.

‘Certificate of Commencement of Business, is issued by the Registrar of Companies to Public Companies. Once a Company has been registered or formed, it shall apply for the Certificate of Commencement of Business in the prescribed form to the ROC (Registrar of Companies). Only after this certificate has been obtained it can commence its business. This certificate has to be obtained within 6 months from the date of incorporation of a Company.’ - No qualification shares and consent of the Director to act as a Director is required to be filed with the ROC at any time during the tenure of the company, as in case of a Public company.

- A Private Company is not required to issue or file a prospectus or statement in lieu of prospectus with the Registrar of Companies.

‘Prospectus, is an important document for a public company. It is nothing but an invitation to the public to subscribe for the shares of the Company. In case a public company does not intend to invite the public to subscribe to the shares, it has to file a statement in lieu of prospectus. - It is not required to have an index of members, as in case of a public company. The reason being the Companies Act limits the maximum number of members required for a Private Company to 50.

- It is not required to hold a statutory meeting or file a statutory report.

‘Statutory meeting is a general meeting of the shareholders of the Company which has to be held within a period of not less than one month and not more than 6 months from the date, on which it is entitled to commence its business.” - It is not required to offer new shares to existing shareholders in proportion to their shareholdings.

In case of a Public Company further issue of capital shall be made to the persons who at the date of the issue are holders of the equity shares of the Company in proportion to their holding. - A Private Company need to have a minimum of two directors only whereas a Public Company needs to have a minimum of three directors.

- All the Directors may be appointed by a single resolution in case of a Private Company.

- The Directors of a Private Company need not to retire by rotation i.e., they can be Permanent Directors.

Question 7. How does a cooperative society exemplify democracy and secularism? Explain.

Answer: Cooperative is a form of organization wherein persons voluntarily associate together as human beings on the basis of equality for the promotion of an economic interest for themselves. In a cooperative society, the power to take decisions lies in the hands of an elected managing committee. The right to vote gives the members a chance to choose the members who will constitute the managing committee and this lends the cooperative society a democratic character. Also, the principle of ‘one man, one vote’ governs the cooperative society, irrespective of the amount of capital contribution by a member, each member is entitled to equal voting rights. The membership of a cooperative society is voluntary. A person is free to join a cooperative society, and can also leave anytime as per his desire. Membership is open to all, irrespective of their religion, caste and gender. Thus, by keeping all these points in mind, a cooperative society exemplifies democracy and secularism.

Question 8. What is meant by ‘partner by estoppel’? Explain.

Answer: When a person, by words spoken or written or by conduct, represents himself or herself, or consents to another representing him or her to anyone, as a partner in an existing partnership or with one or more persons not actual partners, he or she is liable to any such person to whom such representation has been made, who has, on the faith of such representation, given credit to the actual or apparent partnership and, if he or she has made such representation or consented to its being made in a public manner, he or she is liable to such person, whether the representation has or has not been made or communicated to such person so giving credit by or with the knowledge of the apparent partner making the representation or consenting to its being made, as follows:

- If a partnership liability results, he or she is liable as though he or she were an actual member of the partnership.

- If no partnership liability results, he or she is liable jointly with the other persons, if any, so consenting to the contract or representation as to incur liability, otherwise separately.

- When a person has been thus represented to be a partner in an existing partnership, or with one or more persons not actual partners, that person is an agent of the persons consenting to such representation to bind them to the same extent and in the same manner as though that person were a partner in fact, with respect to persons who rely upon the representation where all the members of the existing partnership consent to the representation, a partnership act or obligation results; but in all other cases it is the joint act or obligation of the person acting and the persons consenting to the representation.

III. Long Answer Type Questions

Question 1. What do you understand by a.sole proprietorship firm? Explain its merits and limitations.

Answer: If entrepreneur starts sole proprietor form of business, then he has the following advantages.

Advantages of Sole Proprietor Form of Business:

1. Easy formation: The formation of sole proprietorship business is very easy and simple. No legal formalities are involved for setting up the business except a license or permission in certain cases. The entrepreneur with initiative and certain amount of capital can set up such form of business.

2. Direct motivation: The entrepreneur owns all and risks all. The entire profit goes to his pocket. This motivates the proprietor to put his heart and soul in the business to earn more profit. Thus, the direct relationship between effort and reward motivates the entrepreneur to manage the business more efficiently and effectively.

3. Better control: The entrepreneur takes all decisions affecting the business. He chalks out the plan and executes the same. His eyes are on everything and everyone. There is no scope for laxity. This results in better control of the business and ultimately leads to efficiency.

4. Promptness in decision-making: When the decision is to be taken by one person, it is sure to be quick. Thus, the entrepreneur as sole proprietor can arrive at quick decisions concerning the business by which he can take the advantage of any better opportunities.

5. Secrecy: Each and every aspect of the business is looked after by the proprietor and the business secrets are known to him only. He has no legal obligation to publish his accounts. Thus, the maintenance of adequate secrecy leaves no scope to his competitors to be aware of the business secrets.

6. Flexibility in operations: The sole proprietorship business is undertaken on a small scale. If any change is required in business operations, it is easy and quick to bring the changes.

7. Scope for personal touch: There is scope for personal relationship with the entrepreneur and customers in sole proprietorship business. Since the scale of operations is small and the employees work under his direct supervision, the proprietor maintains a harmonious relationship with the employees. Similarly, the proprietor can know the tastes, likes and dislikes of the customers because of his personal rapport with the customers.

8. Free from Government control: Sole proprietorship is the least regulated form of business. Regulated laws are almost negligible in its formation, day-to-day operation and dissolution.

Disadvantages of Sole Proprietor Form of Business:

The sole proprietorship business is not free from criticism. It suffers from certain limitations and drawbacks, because of its very nature and scope of operations. These points may be duly taken care of while entrepreneur adopting this mode of business.

1. Limited resources: The financial resources of any small business as an individual is limited. He mainly finances from his own savings or borrows from financial institutions, friends and relatives as per his capacity. Thus, limited resource is the major drawback of this form of business.

2. Limited managerial capability: Modern business requires updated managerial skills in each and every sphere of activity. We cannot hope a single individual to possess all the managerial, talents necessary to carry on a business efficiently. The limited financial resources of the sole proprietorship is a hindrance to hire the services of managers with expertise in different areas, thereby the growth of the business.

3. Unlimited liability: Since the liability of the sole proprietor is unlimited, the private properties of the proprietor is also at risk. When the business fails, the private properties of the owner are utilized to pay off the business debts. Thus, the proprietor must have to look this aspect carefully.

4. Uncertainty of continuity: The continuity of the business is uncertain because the business may come to an end due to the incapacity or death of the proprietor. Even if at all the business passes on to the successor of the proprietor, it is unlikely that they may pose the business acumen like that of the proprietor. The discontinuance of the business is a social loss.

5. Not suitable for large-scale business: The limited financial resources, limited managerial capability of the proprietor, risk to the private property etc. makes the proprietorship business unsuitable for large-scale business. This system of business cannot afford for large-scale operation.

6. Difficult to maintain personal contact: Even though there is scope for personal touch in sole proprietorship business, it is unlikely to happen when the business is undertaken in different areas. It is not so easy on the part of the proprietor to have personal contact with customers and suppliers at the same time.

Question 2. Why is partnership considered by some to be a relatively unpopular form of business ownership? Explain the merits and limitations of partnership.

Answer: Partnership is considered by some to be relatively unpopular form of business ownership because:

- Uncertainty of duration: A partnership suffers from a possible limited span of life. Legally, a partnership firm must be dissolved on the retirement, death, bankruptcy, or lunacy of any partner or demanded by any partner. The probability of any one of these events occurring when the number of partners is much greater than in the case of a sole proprietor.

- Risks of additional liability: It is true that like the sole proprietor, each partner has unlimited liability. But his liability may arise not only from his own acts but also from the acts and mistakes of co-partners over whom he has no control.

- Lack of harmony: The old saying that “too many cooks spoil the broth” can be apt for a business partnership. Harmony may be difficult to achieve, especially when there are many partners. Lack of centralized authority and conflicts in policy can disrupt the organization.

- Difficulty in withdrawing investment: Investment in a partnership can be simple, but its withdrawal may be difficult or costly when this aspect is considered from the point of view of individual partners. This is so because no partner can withdraw his interest from the firm without the consent of all partners.

- Lack of public confidence: A partnership may suffer from lack of public confidence

- Lack of public confidence: A partnership may suffer from lack of public confidence because, like that of a company there is no legal mechanism to enforce the registration of a partnership firm and the disclosure of its affairs.

- Limited resources: A partnership is good as it can be started with limited capital. However, it becomes a handicap in the growth and expansion phases of the business. There is a limit beyond which it is almost impossible for partners to collect capital. This limit is generally up to the personal properties of the partners.

- Unlimited liability: Unlimited liability discourages partners to undertake risky ventures, and therefore, their risk-taking initiative is very risky.

Merits of Partnership

- It is easy to set up.

- It has more capital, which can be brought into the business.

- Partners brings new skills and ideas to a business.

- Decision-making can be much easier with more brains to think about a problem.

- Partners share responsibilities and duties of the business.

- Division of labour is possible as partners may have different skills.

Limitations of Partnership

- There is an unlimited liability: All the partners are responsible for the debts of the firm and if the business goes bankrupt, all the partners will have to clear the debts even if they have to sell off their personal belongings.

- Disagreement among the partners can lead to problems for the business.

- There is a limit to the capital invested. Because of the fact that maximum 20 members are allowed, the business may find it difficult to expand after a certain limit.

- There is no continuity of existence. Partnership is dissolved if one of the partners die or resigns or becomes bankrupt.

Question 3. Discuss the characteristics, merits and limitations of the cooperative form of organization. Also describe briefly different types of cooperative societies.

Answer: It is important to choose an appropriate form of organization as it will determine:

1. Extent of control;

2. Extent of liability;

3. Availability of resources;

4. Legal formalities.

All these in turn will determine profits of the business.

Different types of cooperative societies are explained below:

- Producer’s cooperative societies: The producer’s cooperatives are established by the small producers. The members of the society produce goods in their houses or at common place. The raw materials, tools, money, etc. are provided to them by the society. The output is collected by the society and sold in the market at the wholesale rate. The profit is distributed among the members in proportion to the goods supplied by each member.

- Consumer’s cooperative societies: Consumer’s cooperative societies are established to remove middlemen from the field of trade. These societies purchase foods at the wholesale prices and sell these goods to the members at cheaper rates than the market prices. However, the goods are sold to the non-members at the market rates. The profit, if any, is distributed among the members in the shape of bonus according to their purchase ratio.

- Marketing cooperative societies: The marketing cooperative societies are formed by the small producers for the promotion of trade. The two main objectives of these societies are, to sell the good at reasonable prices by eliminating middlemen and to make there ready for the product of the member. These types of societies are formed by the small agriculturalist and artisans. These societies collect the products of its members and make its grading and keep them in warehouses and sell them in the market at whole sale rate when the market is ready for these products. The profit is distributed among the members according to the ratio of goods supplied by them.

- Credit cooperative societies: These cooperative societies are formed for the financial help of the members. These societies provide loans to the members at low rate of interest. In rural areas these provide loans to the farmers for the purchase of seeds, fertilizers and cattle. In urban areas these societies provide loan to its members for the purchase of raw materials and tools.

- Farming cooperative societies: These societies are formed by the small agriculturalist to get the benefits of large scale farming. These societies provide help to the farmer for the improve method of cultivations by providing large scale farming tools such as tractors, threshers and harvesters, etc.

- Housing cooperative societies: These societies are formed for the procurement of land for the construction of houses on a homogeneous basis. These societies are formed by those members who are intended to construct their own home. These societies provide loan to the members for the construction of houses. These also purchase construction materials in bulk and provide this material to its member at cheaper rates.

Question.4. Distinguish between a Joint Hindu family business and partnership.

Answer: Differences between Joint Hindu family systems and sole proprietorship are given below:

- Regulating law: A partnership is governed by the provisions of the Indian Partnership Act, 1932. A Joint Hindu family business is governed by the principles of Hindu law.

- Mode of creation: A partnership arises out of a contract, whereas a Joint Hindu family business arises by the operation of law and is not the result of a contract.

- Admission of new members: In a partnership no new partner is admitted without the consent of all the partners, while in the case of a Joint Hindu family firm, a new member is admitted just by birth.

- The position of families: In a partnership women can be full-fledged partners, while in a Joint Hindu family business membership is restricted to male members only. After the passage of the Hindu Succession Act, 1956, families get only co-sharer’s interest at the death of a coparcener and they do not become coparceners themselves.

- Number of members: In partnership the maximum limit of partners is 10 for banking business and 20 for any other business, but there is no such maximum limit of members in the case of Joint Hindu Family business.

- Liability of members: In partnership, the liability of the partners is joint and several as well as unlimited. In other words, each partner is personally and jointly liable to an unlimited extent and if partnership liabilities cannot be fully discharged out of the partnership property each partner’s separate personal property is liable for the debts of the firm.

In a Joint Hindu family business, only the ‘Karta’ is personally liable to an unlimited extent, i.e., his self-acquired or other separate property besides his share in the joint family property is liable, for debts contracted on behalf of the family business.

Question 5. Despite limitations of size and resources, many people continue to prefer sole proprietorship over other forms of organization. Why?

Answer: Despite limitations of size and resources, many people continue to prefer sole proprietorship over other forms of organization because of following merits:

- Easy to start and close: It can be easily started and closed without any legal formalities.

- Quick decision making: As sole trader is not required to consult or inform anybody about his decisions.

- Secrecy: He is not expected to share his business decisions and secrets with anybody.

- Direct incentive: Direct relationship between efforts and reward provide incentive to the sole trader to work hard.

- Personal touch: The sole trader can maintain personal contacts with his customers and employees.

- Social utility: It provides employment to persons with limited money who are not interested to work under others. It prevents concentration of wealth in a few hands.

MORE QUESTIONS SOLVED

I. Multiple Choice Questions

Question 1. Name the form of business organization found only in India.

(a) Sole Proprietorship (6) Partnership

(c) Joint Hindu Family (d) Cooperatives

Question 2. Choose the type of business in which sole proprietorship is very suitable.

(a) CA Firm (b) Beauty Parlour

(c) A shopping mall (d) All of these

Question 3. Name the person who manages a Joint Hindu Family Business.

(a) Manager (b) Minor

(c) Members (d) Karta

Question 4. Name the law which governs Joint Hindu Family Business.

(a) Partnership Act (b) Hindu Law

(c) Companies Act, 1956 (d) Contract Act

Question 5. Which document is called charter of a company?

(a) Memorandum of Association (b) Articles of Association

(c) Prospectus (d) All of the above

Question 6. What is the minimum number of persons required to form a co-operative society?

(a) 2 (6) 7

(c) 10 (d) 20

Question 7. Which of the following has unlimited liability in business?

(a) Sole Proprietor (b) Karta

(c) Partners (d) All of the above

Question 8. Name the type of company which must have a minimum paid up capital of 5 lacks,

(a) Public Company (b) Private Company

(c) Government Company (d) All of the above

Question 9. Which of the following has a separate legal entity?

(a) Joint Stock Company (b) Co-operative Society

(c) Both of the above (d) None of the above

Question 10. Minor can be full-fledged member of:

(a) Co-operative Society (b) Joint Stock Company

(c) Joint Hindu Family (d) Partnership

Answer:

1. (c) 2. (b) 3. (d) 4. (b) 5. (a)

6. (b) 7. (d) 8. (a) 9. (c) 10. (c)

II. Short Answer Type Questions

Question 1. Explain the concept of mutual agency in partnership with suitable example.

Answer: The right of all the partners in a partnership to act as the agents for the partnership’s normal business activities, with the authority to bind the partnership in to business agreements which have been entered into is called mutual agency. This statement sums up the partnership relationship. The relationship should offer flexibility, opportunity and balanced against that, risk. In partnership you entrust to fellow partners your future reputation and prosperity. Each of us has within our power the ability to enter into undertakings which could bankrupt our fellow partners.

Question 2. What is the role of Karta in Joint Hindu Family business?

Answer: In a Hindu Joint Family, the Karta or Manager occupies a pivotal and unique place. In that there is no comparable office or institution in any other system in the world. His office is independent and hence, his position is termed as sui generis.

Karta’s position is sui generis. As had been explained earlier, his position/ office is independent and there is no comparable office in any system in the world.

- He has unlimited powers and even though he acts on behalf of other members, he is not a partner or agent.

- He manages all the affairs of the family and has widespread powers.

- Ordinarily he is accountable to none. The only exception to this rule is if charges of misappropriation, fraud or conversion are levelled against him.

- He is not bound to save, economise or invest. That is to say that he need not invest in land if the land prices are about to shoot up, and hence, miss out on opportunities

etc. He has the power to use the resources as he wishes, unless the above mentioned charges are levelled against him. - He is not bound to pay income of joint family in any fixed proportion to other members. This means that the Karta need not divide the income generated from the joint family property equally among the family members. He can discriminate one member from another and is not bound to treat everyone impartially. Only responsibility is that he has to pay everyone something so that they can avail themselves of the basic necessities such as food, clothing, shelter, education etc. Karta’s Liabilities:

Apart from all the unlimited powers that are bestowed upon the Karta, he also has liabilities thrust on him.

- Karta has to maintain all the members of the joint family properly. If there is any shortfall in his maintenance, then any of the members can sue for maintenance.

- He is responsible for marriage of all the unmarried members in the family. Special emphasis is laid with respect to daughters in this case.

- In case of any partition suit, the Karta has to prepare accounts.

- He has to pay taxes on behalf of the family.

- Karta represents the family in all matters including legal, religious and social matters.

Question 3. Explain procedure of registering a partnership firm.

Answer: Procedure for Registration: In order to get a partnership firm registered an application in the prescribed form must be filed with the Registrar of Firms. The application should contain the following information:

- The name of the firm,

- The principal place of business of the firm,

- Names of other places where the firm’s business is carried on,

- Names in full and permanent addresses of the partners,

- The date on which each partner joined the firm,

- Duration of partnership, if any.

The application should be signed and verified by each partner. A small amount of registration fee is also deposited along with the application. The application is to be submitted to the Registrar for registration of the firm for its verification.

If everything is in order and all legal formalities have been observed, the Registrar shall make an entry in the register of firms. He will also issue a certificate of registration.

Any change in the information submitted at the time of registration, should be communicated to the Registrar. Registration does not provide a legal entity to the partnership firm.

Question 4. Is registration of partnership firm compulsory? What are the consequences of non-registration?

Answer: Registration of a partnership firm is not compulsory under law. The Partnership Act, 1932 provides hat if the partners so desire they may register the firm with the Registrar of Firms of the state in which the main office of the firm is situated.

Consequences of Non-Registration: An unregistered partnership firm suffers from the following situations:

- It cannot enforce its claims against a third party in a court of law.

- It cannot claim adjustment for any sum exceeding Rs 100. Suppose an unregistered firm owes ? 1200 to A and A owes Rs 1000 to the firm the firm cannot enforce adjustment of ? 1000 in a court of law.

- It cannot file a legal suit against any of its partners.

- Partners of an unregistered firm cannot file any suit to enforce a right against the firm.

- A partner of an unregistered firm cannot file a suit against other partners. Non-registration of a firm, however, does not affect the following rights:

- The right of a partner to sue for the dissolution of the firm or for the accounts of a dissolved firm or to enforce any right or power to realise the property of a dissolved firm.

- The power of an Official Assignee or Receiver to realize the property of an insolvent partner.

- The rights of the firm, or its partners, having no place of business.

- Any suit or set off in which the claim does not exceed rupees one hundred.

- The right of a third party to sue the unregistered firm or its partners.

Question 5. What are the steps required for raising funds from public?

Answer: Following steps are required for raising funds from public:

- SEBI Approval: SEBI regulates the capital market of India. A public company is required to take approval from SEBI.

- Filing of Prospectus: Prospectus means any documents which invites offers from the public to purchase share and debenture of the company.

- Appointment of Bankers, Brokers, Underwriters: Bankers of the company receive the application money. Brokers encourage the public to apply for the shares. Underwriters are the persons who undertake to buy the shares if these are not subscribed by the public. They receive a commission for underwriter.

- Minimum Subscription: According to the SEBI guidelines, minimum subscription is 90% of the issue amount. If minimum subscription is not received then the allotment cannot be made and the application money must be returned to the applicants within 30 days.

- Application to Stock Exchange: It is necessary for a public company to list their shares in the stock exchange. Therefore, the promoters apply in a stock exchange to list company shares.

- Allotment of Shares: Allotment of shares means acceptance of share applied. Allotment letters are issued to the shareholders. The name and address of the shareholders is to be submitted to the Registrar.

Question 6. Define Articles of Association. What are its contents?

Answer: The Articles of Association are the rules for the management of the internal affairs of a company. The articles define the duties, rights and power of the officer and director of the company.

Contents of the Articles of Association (It is not an exhaustive but illustrative list)

- The amount of share capital and different types of shares.

- Rights of each class of shareholder.

- Procedure for making allotment of shares.

- Procedure for issuing share certificates.

- Procedure for forfeiture and reissue of share.

- Procedure for conducting, voting and proxy.

- Procedure for appointment of director.

- Procedure for declaration of dividend.

- Procedure for alteration of share capital.

- Procedure regarding winding up of the company.

Question 7. Differentiate between:

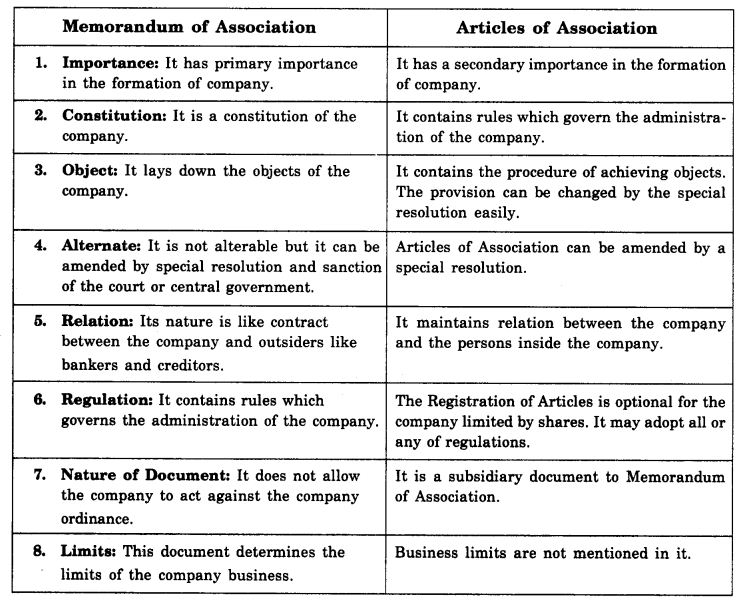

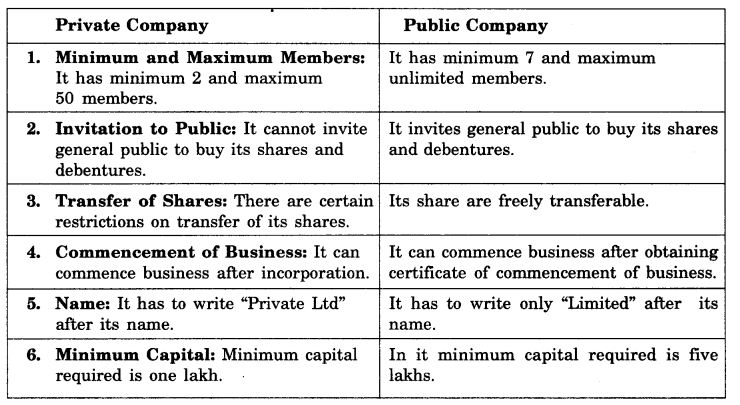

- Memorandum of Association and Articles of Association.

- Private and Public Company

Answer: Differences between Memorandum of Association and Articles of Association

Differences between Public Company and Private Company

Question 8. Define promoter. What are the functions of a promoter?

Answer: Promoter is a person who conceives the idea of starting a business, examines the feasibility of idea, assemble various resources, prepare necessary documents and perform other activities needed to commence the business.

Functions of a promoter

- Identification of business opportunity;

- Feasibility studies: the following feasibility studies may be undertaken:

(a) technical feasibility (b) financial feasibility (c) economic feasibility - Name approval;

- Fixing up signatories to the Memorandum of Association;

- Appointment of professionals;

- Preparation of necessary documents.

Question 9. Explain the contents of Memorandum of Association.

Answer: Contents of Memorandum of Association: The memorandum must contain the following clauses:

- The Name Clause: It contains the name of company with which the company will be known.

- Registered Office Clause: It contains the name of the state, in which the registered office of the company is proposed to be situated.

- Objects Clause: It defines the purpose for which the company is formed. It is further divided into two sub-clauses: (1) the main objects (2) other objects.

- Liability Clause: It states that the liability of members is limited to the amount unpaid on shares owned by them.

- Capital Clause: It specifies the maximum capital, which the company will be authorized to raise through issue of shares.

- Association Clause: In this clause, signatories to the memorandum, state their intention to be associated with the company and give their consent to purchase qualification shares.

III. Long Answer Type Questions

Question 1. What do you mean by incorporation of a company? What are the steps involved in corporation of a company?

Answer: Incorporation of the company: It means registration of the company under Companies Act, 1956. The second stage involves the following steps:

- Filling of documents: An application to the registrar for incorporation must be accompanied with following documents:

- Memorandum of Association;

- Articles of Association or statement in lieu of the prospectus (in case table A is adopted by public limited company);

- Written consent of proposed directors;

- Agreement (if any) with proposed managing director, manager, etc.;

- Copy of registrar’s letter approving the company’s name;

- Statutory declaration;

- Notice of the exact address of the registered office.

- Payment of fees: Along with the above documents, necessary fees is to be paid.

- Certificate of incorporation: The registrar issues a certificate of incorporation after being satisfied. Certificate is a conclusive evidence of regularity of incorporation of a company irrespective of any deficiency in its registration.

Question 2. Explain different types of partners.

Answer: Different types of partners are given below:

- General/Active Partner: Such a partner takes active part in the management of the firm.

- Sleeping of Dormant Partner: Although he does not take active part in the management of the firm, he invests money, shares profit and loss, has unlimited liability.

- Secret Partner: He participates in business secretly without disclosing his association with the firm to general public. His liability is also unlimited.

- Nominal Partner: Such a partner only gives his name and goodwill to the firm. He neither invests money nor takes profit. But his liability is unlimited.

- Partner by Estoppels: He is the one who by his words or conduct gives impression to the outside world that he is a partner of the firm whereas actually he is not. His liability is unlimited towards the third party who has entered into dealing with firm on the basis of his pretension.

- Partner by Holding out: He is the one who is falsely declared partner of the firm whereas actually he is not. And even after becoming aware of it, he does not deny it. His liability is unlimited towards the party who has dealt it with firm on the basis of this declaration.

Question 3. Explain meaning, features, merits and demerits of Sole Proprietorship.

Answer: Sole Proprietorship means a business owned, financed and controlled by a single person who is recipient of all profits and bearer of all risks. It is suitable in areas of

personalized services like beauty parlour, hair cutting saloons and small scale activities like retail shops.

Features:

- Single Ownership: It is wholly owned by one individual.

- Control: Sole proprietor has full power of decision making.

- No Separate legal entity: Business and businessman are not separate entities in the eyes of law.

- Unlimited liability: The liability of owner is unlimited. In case the assets of business are not sufficient to meet its debts, the personal property of owner can be used for paying debts.

- No legal formalities: No legal formalities are required to start, manage and dissolve such business organization.

- Sole risk bearer and profit recipient: He bears the complete risk and there is nobody to share profit / loss with him.

Merits:

- Easy to start and close: It can be easily started and closed without any legal formalities.

- Quick decision making: As sole owner is not required to consult or inform anybody about his decisions.

- Secrecy: He is not expected to share his business decisions and secrets with anybody.

- Direct incentive: Direct relationship between efforts and reward provide incentive to the sole trader to work hard.

- Personal touch: The sole trader can maintain personal contacts with his customers and employees.

- Social utility: It provides employment to persons with limited money who are not interested to work under others. It prevents concentration of wealth in a few hands.

Limitations:

- Limited financial resources: Funds are limited to the owner’s personal savings and his borrowing capacity.

- Limited managerial ability: Sole trader can’t be good in all aspects of business and he can’t afford to employ experts also.

- Unlimited liability: Unlimited liability of sole trader compels him to avoid risky and bold business decisions.

- Uncertain life: Death, insolvency, lunacy or illness of a proprietor affects the business and can lead to its closure.

- Limited scope for expansion: Due to limited capital and managerial skills, it cannot expand to a large scale.

Question 4. Explain meaning, features, merits and demerits of partnership firm.

Answer: Partnership is a voluntary association of two or more persons who agree to carry on some business jointly and share its profits and losses. The partnership was evolved to overcome the shortcomings of sole proprietorship and Joint Hindu Family business.

Features:

- Two or more persons: There must be at least two persons to form a partnership. The maximum number of persons is 10 in banking business and 20 in non-banking business.

- Agreement: It is an outcome of an agreement among partners which may be oral or in writing.

- Lawful business: It can be formed only for the purpose of carrying on some lawful business.

- Decision making and control: Every partner has a right to participate in management and decision making of the organization.

- Unlimited liability: Partners have unlimited liability.

- Mutual agency: Every partner is an implied agent of the other partners and of the firm. Every partner is liable for acts performed by other partners on behalf of the firm.

- Lack of continuity: Firms existence is affected by the death, lunacy and insolvency of any of its partner. It suffers from lack of continuity.

Merits:

- Ease of formation and closure: It can be easily formed. Only an agreement among the partners is required.

- Larger financial resources: There are more funds as capital is contributed by number of partners.

- Balanced decisions: As decisions are taken jointly by partners after consulting each other.

- Sharing of risks: In it, risk gets distributed among partners which reduces anxiety, burden and stress on individual partner.

- Secrecy: Secrecy can be easily maintained about business affairs as they are not required to publish their accounts or to file any report to the government.

Limitations:

- Limited resources: There is a restriction on the number of partners and hence capital contributed by them is also limited.

- Unlimited liability: The liability of partners is unlimited and they are liable individually as well as jointly. It may prove to be a big drawback for those partners who have greater personal wealth. They will have to repay the entire debt in case the other partners are unable to do so.

- Lack of continuity: Partnership comes to an end with the death, retirement, insolvency or lunacy of any of its partners.

- Lack of public confidence: Partnership firms are not required to publish their reports and accounts. Thus they lack public confidence.

Question 5. Explain meaning, features, merits and demerits of joint stock company.

Answer: Joint stock company is a voluntary association of persons having a separate legal existence, perpetual succession and common seal. Its capital is divided into transferable shares.

Features:

- Separate legal existence: It is created by law and it is a distinct legal entity independent of its members. It can own property, enter into contracts, can file suits in its own name.

- Perpetual existence: Death, insolvency and insanity or change of members has no effect on the life of a company. It can come to an end only through the prescribed legal procedure.

- Limited Liability: The liability of every member is limited to the nominal value of the shares bought by him or to the amount, guaranteed by him.

- Transferability of shares: Shares of public company are easily transferable. But there are certain restrictions on transfer of share of private company.

- Common seal: It is the official signature of the company and it is affixed on all important documents of company.

- Separation of ownership and control: Management of company is in the hands of elected representatives of shareholders known individually as director and collectively as board of directors.

Merits:

- Limited liability: Limited liability of shareholders reduces the degree of risk borne by him.

- Transfer of Interest: Easy transferability of shares increases the attractiveness of shares for investment.

- Perpetual existence: Existence of a company is not affected by the death, insanity, insolvency of member or change of membership. Company can be liquidated only as per the provisions of companies Act.

- Scope for expansion: A company can collect huge amount of capital from unlimited number of members who are ready to invest because of limited liability, easy transferability and chances of high return.

- Professional management: A company can afford to employ highly qualified experts in different areas of business management.

Limitations:

- Legal formalities: The procedure of formation of company is very long, time consuming, expensive and requires lot of legal formalities to be fulfilled.

- Lack of secrecy: It is very difficult to maintain secrecy in case of public company, as company is required to publish and file its annual accounts and reports.

- Lack of motivation: Divorce between ownership and control and absence of a direct link between efforts and reward lead to lack of personal interest and incentive.

- Delay in decision making: Red tapism and bureaucracy do not permit quick decisions and prompt actions. There is little scope for personal initiative.

- Oligarchic management: Company is said to be democratically managed but actually managed by a few people i.e., Board of Directors. Sometimes they take decisions keeping in mind their personal interests and benefit, ignoring the interests of Shareholders and company.

Question 6. Explain the meaning, features, merits and demerits of cooperative society.

Answer: A cooperative society is a voluntary association of persons of moderate means, who unite together to protect and promote their common economic interests.

Features:

- Voluntary association: Everyone having a common interest is free to join a cooperative society and can also leave the society after giving proper notice.

- Legal status: Its registration is compulsory and it gives it a separate identity.

- Limited liability: The liability of the member is limited to the extent of their capital contribution in the society.

- Democratic control: Management and control lies with the managing committee elected by the members by giving vote. Every member has one vote irrespective of the number of shares held by him.

- Service motive: The main aim is to serve its members and not to maximize the profit.

- State control: They have to abide by the rules and regulations framed by government for them.

- Distribution of surplus: The profit is distributed on the basis of volume of business transacted by a member and not on the basis of capital contribution of members.

Merits:

- Ease of formation: It can be started with minimum of 10 members. Registration is also easy as it requires very few legal formalities.

- Limited liability: The liability of members is limited to the extent of their capital contribution.

- Stable existence: Due to registration it is a separate legal entity and is not affected by death, lunacy or insolvency of any of its members.

- Economy in operations: There is economy in operation due to elimination of middle man and voluntary services provided by its members.

- Government support: Government provides support by giving loans at lower interest rates, subsidies and by charging less taxes.

- Social utility: It promotes personal liberty, social justice and mutual cooperation. They help to prevent concentration of economic power in a few hands.

Limitations:

- Shortage of capital: It suffers from shortage of capital as it is usually formed by people with limited means.

- Inefficient management: Cooperative society is managed by elected members who may not be competent and experienced. Moreover it can’t afford to employ expert and experienced people at high salaries.

- Lack of motivation: Members are not inclined to put their best efforts as there is no direct link between efforts and reward.

- Lack of secrecy: Its affairs are openly discussed in its meeting which makes it difficult to maintain secrecy.

- Excessive government control: It suffers from excessive rules and regulations of the government. It has to get its accounts audited by the auditor and has to submit a copy of its accounts to registrar.

- Conflict among members: The members are from different sections of society with different view points. Sometimes when some members become rigid, the result is conflict.

Question 7. Explain different types of partners.

Answer: The different kinds of partners that are found in partnership firms are as follows:

- Active or managing partner: A person who takes active interest in the conduct and management of the business of the firm is known as active or managing partner. He carries on business on behalf of the other partners. If he wants to retire, he has to give a public notice of his retirement; otherwise he will continue to be liable for the acts of the firm.

- Sleeping or dormant partner: A sleeping partner is a partner who ‘sleeps’, that is, he does not take active part in the management of the business. Such a partner only contributes to the share capital of the firm, is bound by the activities of other partners, and shares the profits and losses of the business. A sleeping partner, unlike an active partner, is not required to give a public notice of his retirement. As such, he will not be liable to third parties for the acts done after his retirement.

- Nominal or ostensible partner: A nominal partner is one who does not have any real interest in the business but lends his name to the firm, without any capital contributions, and doesn’t share the profits of the business. He also does not usually have a voice in the management of the business of the firm, but he is liable to outsiders as an actual partner.

- Partner by estoppel or holding out: If a person, by his words or conduct, holds out to another that he is a partner, he will be stopped from denying that he is not a partner. The person who thus becomes liable to third parties to pay the debts of the firm is known as a holding out partner.

There are two essential conditions for the principle of holding out : (a) The person to be held out must have made the representation, by words written or spoken or by conduct, that he was a partner ; and (b) The other party must prove that he had knowledge of the representation and acted on it, for instance, gave the credit. - Partner in profits only: When a partner agrees with the others that he would only share the profits of the firm and would not be liable for its losses, he will own as partner in profits only.

- Minor as a partner: A partnership is created by an agreement. And if a partner is incapable of entering into a contract, he cannot become a partner. Thus, at the time of creation of a firm a minor (i.e., a person who has not attained the age of 18 years) cannot be one of the parties to the contract. But under section 30 of the Indian Partnership Act, 1932, a minor ‘can be admitted to the benefits of partnership, with the consent of all partners. A minor partner is entitled to his share of profits and to have access to the accounts of the firm for purposes of inspection and copy.

He, however, cannot file a suit against the partners of the firm for his share of profit and property as long as he remains with the firm. His liability in the firm will be limited to the extent of his share in the firm, and his private property cannot be attached by creditors.

On his attaining majority, he has to decide within six months whether he will remain regular partner or withdraw himself from partnership. The choice in either case is to be intimated through a public notice, failing which he will be treated to have decided to continue as a partner, and he becomes personally liable like other partners for all the debts and obligations of the firm from the date of his admission to its benefits (and not from the date of his attaining the age of majority). He also becomes entitled to file a suit against other partners for his share of profit and property. - Other partners: In partnership firms, several other types of partners are also found, namely, secret partner who does not want to disclose his relationship with the firm to the general public. Outgoing partner, who retires voluntarily without causing dissolution of the firm, limited partner who is liable only up to the value of his capital contributions in the firm, and the like.

IV. Higher Order Thinking Skills (HOTS)

Question 1. X is interested in the floatation of a company. Briefly discuss the steps he should take.

Answer: Stages in the formation of a company: The formation of a company involves the following four stages:

1. Promotion,

2. Incorporation,

3. Subscription of capital,

4. Commencement of business.

These four stages are relevant for formation of a public limited company. For a private limited company, only the first two stages are needed.

- Promotion: Promotion stage includes all the steps right from the identification of a business opportunity till the company is formed. All the tasks during the stage of promotion are performed by a promoter.

- Incorporation of the company: It means registration of the company under Companies Act, 1956. This second stage involves the following steps:

1. Filing of documents: An application to the registrar for incorporation must be accompanied with the following documents:

(i) Memorandum of Association.

(ii) Articles of Association or statement in lieu of the prospectus (in case table A is adopted by Public Limited Company).

(iii) Written consent of proposed directors.

(iv) Agreement (if any) with proposed managing director, manager, etc.

(v) Copy of registrar’s letter approving the company’s name.

(vi) Statutory declaration.

(vii) Notice of the exact address of the registered office

2. Payment of fees: Along with the above documents, necessary fees is to be paid.

3. Certificate of Incorporation: The registrar issues a certificate of incorporation after being satisfied. Certificate is a conclusive evidence of regularity of incorporation of a company irrespective of any deficiency in its registration. - Capital subscription: In the stage, following steps are required to be followed by public company to raise funds from the public:

- SEBI approval;

- Filling of prospectus or statement in lieu of prospectus;

- Appointment of bankers, brokers and underwriters;

- Minimum subscription;

- Application to stock exchange.

- Commencement of business: In this stage, public company makes an application (along with some documents) to registrar for issue of “Certificate of Commencement of Business”. The registrar issues the certificate after being satisfied. The company can start its business activities from the date of issue of the certificate.

Question 2. Distinguish between Joint Hindu Family Business and Partnership.

Answer:

- Regulating law: A partnership is governed by the provisions of the Indian Partnership Act, 1932. A Joint Hindu Family business is governed by the principles of Hindu law.

- Mode of creation: A partnership arises out of a contract, whereas a Joint Hindu family business arises by the operation of law and is not the result of a contract.

- Admission of new members: In a partnership no new partner is admitted without the consent of all the partners, while in the case of a Joint Hindu family firm a new member is admitted just by birth.

- The position of females: In a partnership women can be full-fledged partners, while in a Joint Hindu family business membership is restricted to male members only. After the passage of the Hindu Succession Act, 1956, females get only co-sharer’s interest at the death of a coparcener and they do not become coparceners themselves.

- Number of members: In partnership the maximum limit of partners is 10 for banking business and 20 for any other business but there is no such maximum limit of members in the case of Joint Hindu Family business.

- Authority of members: In partnership each partner has an implied authority to bind his co-partners by act done in the ordinary course of the business, there being mutual agency between various partners.

In a joint family business all the powers are vested in the ‘Karta’ and he is the only representative of the family who can contract debts or bind his coparceners by acts done in the ordinary course of business, there being no mutual agency between various coparceners. - Liability of members: In partnership, the liability of the partners is joint and several as well as unlimited. In other words, each partner is personally and jointly liable to an unlimited extent and if partnership liabilities cannot be fully discharged out of the partnership property each partner’s separate personal property is liable for the debts of the firm. In a Joint Hindu family business only the ‘Karta’ is personally liable to an unlimited extent, i.e., his self-acquired or other separate property besides his share in the joint family property is liable, for debts contracted on behalf of the family business. Other coparceners’ liability is limited to the extent of their interest in the joint family property and they do not incur any personal liability.

- Right of members to share in profits: In a partnership each partner is entitled to claim his separate share of profits but a member of a Joint Hindu family business has no such right. His only remedy lies in a suit for partition.

Question 3. Explain the factors which affect the choice of form of business organization.

Answer: The following factors are important for taking decision about form of organization.

- Cost and Ease in Setting up the Organization: Sole proprietorship is least expensive and can be formed without any legal formalities to be fulfilled. Company is most expensive with a lot of legal formalities.

- Capital Consideration: Business requiring less amount of finance prefer sole proprietorship and partnership form, where as business activities requiring huge financial resources prefer company form.

- Nature of Business: If the work requires personal attention such as tailoring unit, hair cutting saloon, it is generally set up as a sole proprietorship. Units engaged in large scale manufacturing are more likely to be organized in company form.

- Degree of Control Desired: A person who desires full and exclusive control over business prefers proprietorship rather than partnership or Co. because control has to be shared in these cases.

- Liability or Degree of Risk: Projects which are not very risky can be organized in the form of sole proprietorship and partnership. Whereas the risky ventures should be done in company form of organization because the liability of shareholders is limited.

Question 4. Which form of business is suitable for following types of business and why?

(a) Beauty Saloon;

(b) Garments shop;

(c) Garment Factory.

Answer: (a) Beauty Saloon: Sole Proprietor is the right form of business because:

- It needs limited capital.

- It is easy to form.

- Entire profits will belong to the owner.

- It requires personal attention.

(b) Garments Shop: Sole Proprietor is the right form of business because:

- It needs limited capital.

- It is easy to form.

- Entire profits will belong to the owner.

(c) Garment Factory: Partnership is more suitable because:

- It can be easily started and closed without any legal formalities.

- He is not expected to share his business decisions and secrets with anybody.

- Direct relationship between efforts and reward provide incentive to the sole trader to work hard.

- The sole trader can maintain personal contacts with his customers and employees.

- It provides employment to persons with limited money who are not interested to work under others. It prevents concentration of wealth in a few hands.

Question.5. Differentiate between a Joint Stock Company and a Cooperative Society.

Answer. The main differences between Cooperative Organisation and Company Organisation are given below:

- Governing statute: A company is governed by the Companies Act, 1956 while a co-operative organisation is subject to the provisions of the Cooperative Societies Act, 1912 or State Cooperative Societies Acts.

- Basic objects: The primary objective of a cooperative society is to provide service, whereas a company seeks to earn profits. This does not mean that a cooperative society does not earn profits or a company does not render service to society.

It simply means that all the activities of a cooperative society are guided by service motive and profits are incidental to this objective. On the other hand, the activities of a company are inspired by profit taking and services rendered to society are incidental to profit motive. - Number of members: The minimum number of persons is 7 in a public company and 2 in a private company. A cooperative requires at least 10 members. The maximum number of members is 50 in a private company and 100 in cooperative credit society. There is no maximum limit in case of public companies and non-credit cooperative societies.

- Member’s liability: The liability of members of a company is generally limited to the face value of shares held or the amount of guarantee given by them though the Companies Act permits unlimited liability to companies. The members of a cooperative society can opt for unlimited liability. But in practice their liability is generally limited.

- Management and control: The management of a cooperative society is democratic as each member has one vote and there is no system of proxy. In a company, the number of votes depends upon the number of shares and proxies held by a member.

There is little separation between ownership and management in a cooperative society due to limited and local membership. - Distribution of surplus: The profits of a company are distributed as dividends in proportion to the capital contributed by the members.

In a cooperative society a minimum part of surplus must be set aside as a reserve and for the general welfare of the public. The rest is distributed in accordance with

the patronage provided by different members after paying dividend up to 10 per cent on capital. - Share capital: In a company, one member can buy any number of shares but an individual cannot buy more than 10 per cent of the total number of shares or shares worth Rs 1,000 of a cooperative society.

A public company must offer new shares to the existing members while a cooperative society issues new shares generally to increase its membership.

The subscription list of a cooperative society is kept open for new members whereas, the subscription list of a company is closed after subscriptions. A company is thus capitalistic in nature while a cooperative society is socialistic. - Transferability of interest: The shares of a public limited company are freely transferable while the shares of cooperative society cannot be transferred but can be returned to the society in case a member wants to withdraw his membership. A member of a cooperative society can withdraw his capital by giving a notice to the society. A shareholder, on the other hand, cannot demand back his capital from the company until it’s winding up.

Question 6. How is a partnership firm different from a sole proprietorship?

Answer: The difference between a partnership and sole proprietorship form of business may be as follows. This helps the entrepreneur in selecting form of business of his choice.

- Membership: Partnership is owned by two or more persons subject to the limit ten in banking business and twenty in case of other business. Sole proprietorship is owned by one and only one person.

- Formation: It is formed through an agreement which may be oral or in writing, is formed quite easily as it is the outcome of a single person’s decision without any legal administrative approval.

- Registration: The registration is not compulsory. It needs no registration except some compliance.

- Regulating law: It is governed by the rules contained under the Indian Partnership Act, 1932. There is no specific statutory law to govern the functioning of sole proprietors business.

- Capital: There is more scope for raising a larger amount of capital as there are more than one person. It has a limited financial capability. Hence, the scope for rising capital is naturally least.

- Quickness in decision-making: Decision-making in partnership is corporately delayed as the partners arrive at decision after consultation with one another. The decision of the sole proprietor is prompt as he need not consult anyone.

- Maintenance of secrecy: Maintenance of absolute secrecy is not possible if partnership as business secrets are accessible to more than one partners. The sole proprietor need not share his business secrets with anybody.

- Management: Every partner has the right to take active part in the management of the business. Each partner also enjoys the authority to bind the firm and other partners for his acts in the ordinary course of business. The sole proprietorship is self-managed one and a few employees may support him. However, the decision of the proprietor is final and binding.

(i) Risk: The risk connected with the business is comparatively less as it is shared by all the partners. The risk of the sole proprietor is greater than that of partnership form of business.

(j) Duration: It continues as long as the partners desire. Even though legally it comes to an end on the death, insolvency or retirement of any of the partners, the business is continue with the remaining partners. It comes to an end with the death, insolvency incapacity of the proprietor. Thus, there is uncertainty of duration of sole proprietorship

V. Value Based Questions

Question 1. From social welfare point of view, which type of organization is most desirable from employment generation point of view?

Answer: Sole Proprietorship is most desirable from employment generation point of view because it is done at a small scale and small scale labour intensive methods are used. It will create more employment opportunities.

Question 2. Which value is of utmost importance when partnership form of business is used?

Answer: Maintaining trust and confidentiality of information is of utmost importance in a partnership business.

It is also important to use mutual agency in utmost good faith keeping in mind the interests of all partners.